News

Landlords had written to the Government in a plea to allow them to aggressively collect rent again. However, the moratorium on legal action by landlords against tenants that have been unable to pay rent due to Coronavirus has been extended until 30th June 2021. The Government said this “final extension” to offer protection from the threat of eviction

The aim of the new Bill is to introduce to law: Corporate moratorium to protect companies in rescue procedures Cross Class Cram Down Procedure Ban on landlords WUPs (Temp to 30/6/2020) Suspension of wrongful trading (s214 Insolvency Act 1986) Termination clauses in supply contracts (if buyer insolvent) Public company meeting rule changes etc My focus,

This programme includes all you, as a director or advisor“need to know” to get an insolvent and non-viable companywound up, legally, effectively and efficiently. Of course, the whole corporate insolvency field is hugelycomplicated and heavily regulated by the Insolvency legislation, sothis short guide can only be a general guide for worried directorsand accountants or advisors.

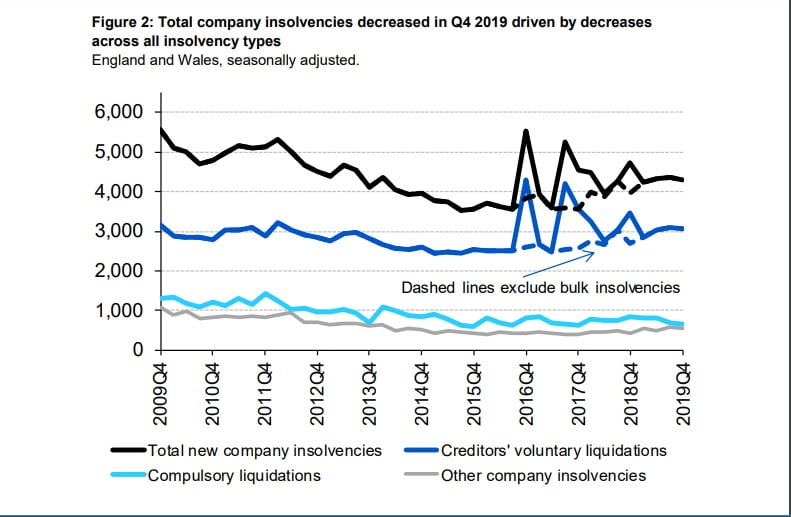

The insolvency statistics for Q4 2019 (England, Scotland and Northern Ireland) have been released. You can access the full publication here but in this article we provide an overview of the key findings. 2019 overall: In 2019, there were 17,196 underlying company insolvencies, this being the highest annual level since 2013. This was mainly driven by an increase

AN INVITATION KSA Group Ltd has great pleasure in inviting you to The Great CVA Debate (Free to attend) Are current CVAs for national retail chains being used fairly and ethically? on Thursday 7th November 2018 Reception at 5.30 pm Debate 6.30 pm at KSA Group’s Offices 99 Bishopsgate London

KSA Group Limited, one of the UK’s leading insolvency practitioners, has researched the UK SME market of over 4m businesses in an attempt to see if there was a gender bias on the board of companies that became insolvent. The study was designed to investigate if the insolvency rate was higher for male or female-run

Worried About Starting up your business or growing your existing business? Employment compliance and pensions? Marketing and product/ service delivery? Management accounts? Tax returns? Auto enrollment? Business premises? Dealing with Banks? Dealing with HMRC? Cashflow problems? Personal guarantees? How to pay HMRC? How to win new work? How to pay wages on pay day? Download

Somerset-based Quantock Brewery has entered administration. Joint administrators from KSA Group, Eric Walls and Wayne Harrison, were appointed to the company on Wednesday 18th January. The company will continue to trade as normal while a buyer is sought for the business. The company said in a statement: “It is with deep regret that following a